Order Flow Analysis

Where price, time and traded volume tell the story of any market, order flow can be an extremely powerful foreshadowing device. It gives you a look at how much business buyers and sellers are waiting transact, and at what prices, before those trades actually execute. This makes order flow an important 4th dimension of modern electronic markets. We invite you to take a quick read through our Crash Course now.

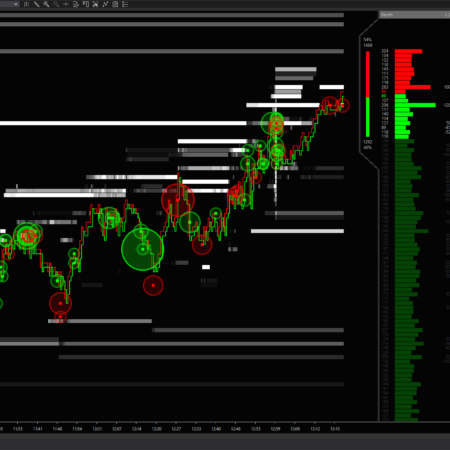

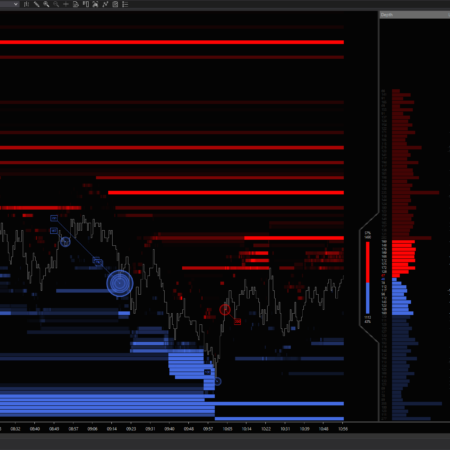

Many traders feel intimidated by order flow concepts. Depth of market (DOM) displays usually contain a lot of numbers that change frequently, leaving traders with headaches, blurry eyesight and mental fatigue. But that need not be the case in order to benefit from this information. We’ve developed a set of tools to distill and visualize the real-time order flow in any instrument for which you have Level 2 (aka market depth) data.

*Note that your provider must supply you with Level 2 data in order for order flow indicators and studies to function. Historical Level 2 data isn’t commonly available from data providers, so historical data can only be recorded while the indicators are running and real-time data is streaming.