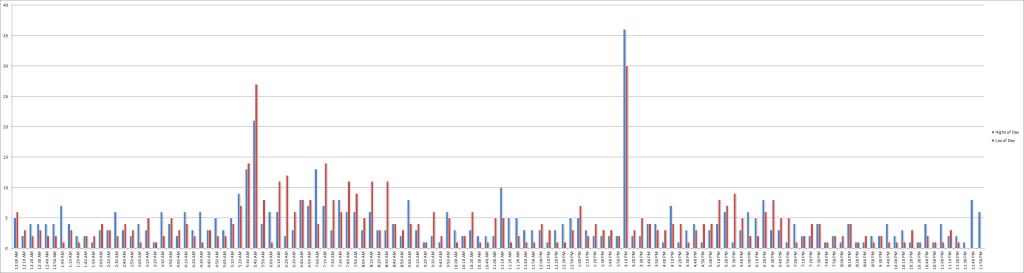

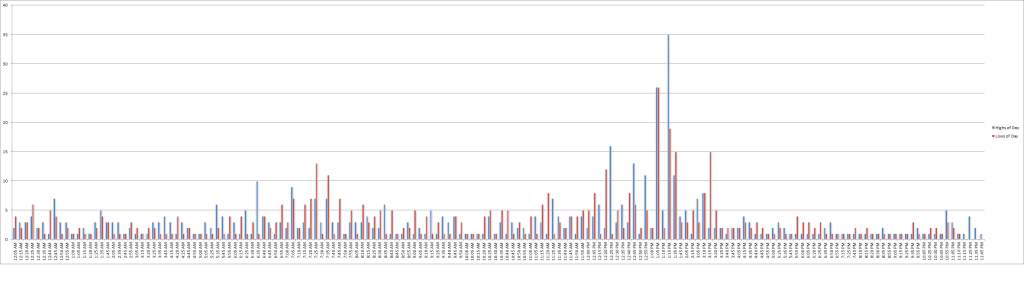

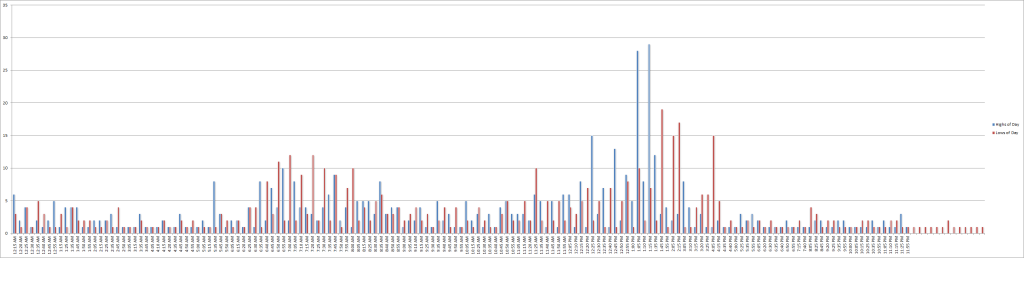

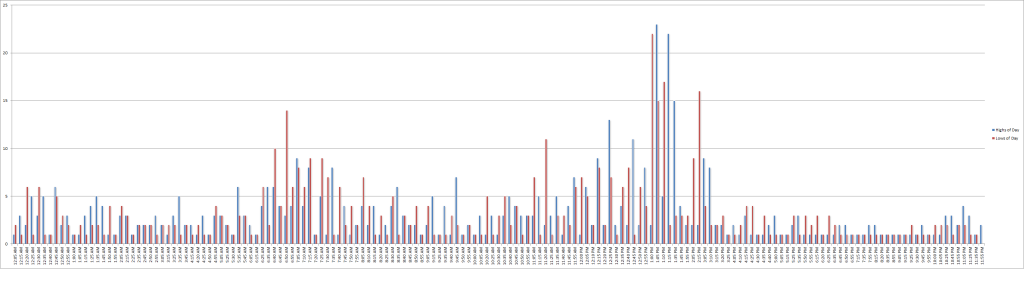

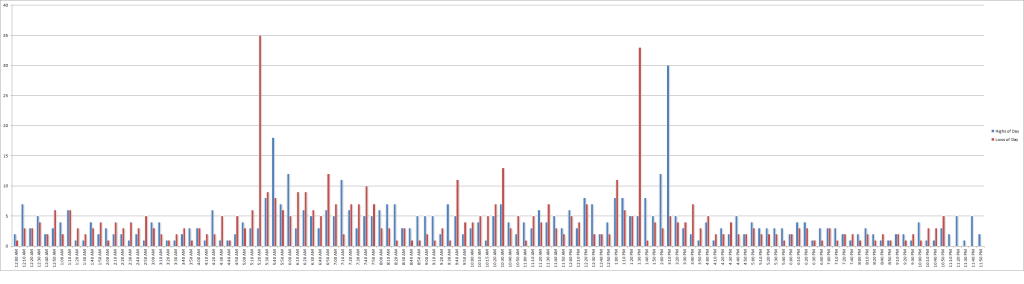

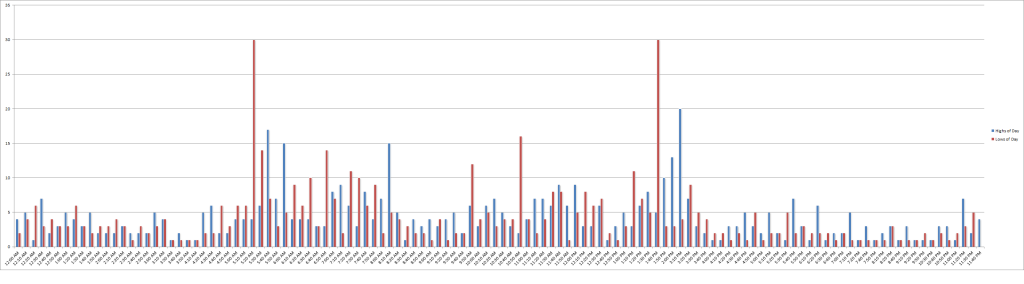

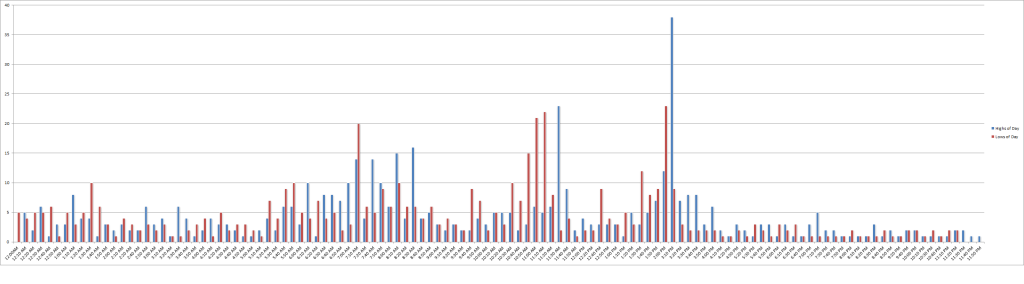

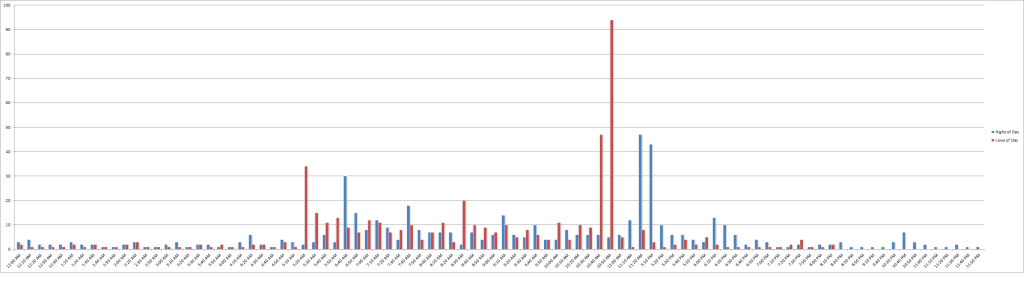

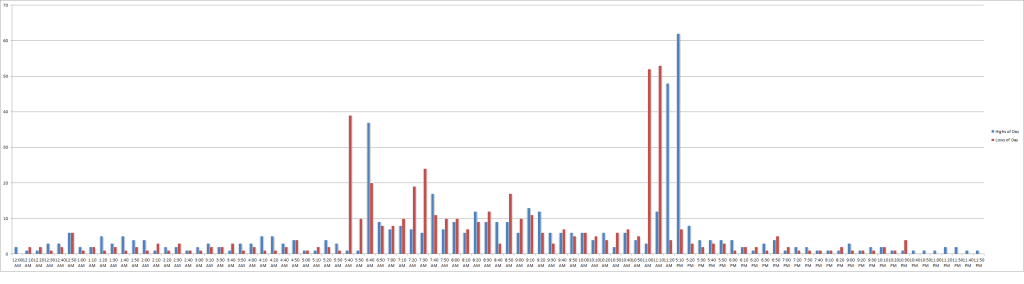

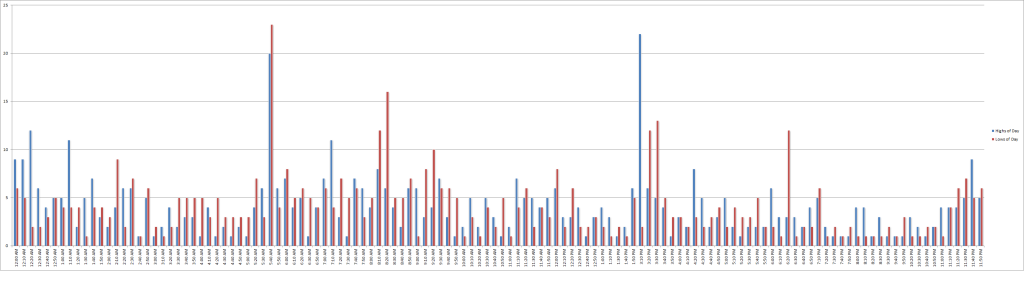

Most Probable Times for Highs and Lows of the Day – 10 Futures Contracts

Question – do you know what times of day your instrument is most likely to make its high or low for the day?

No?

Maybe you should. For example, let’s say price is in the middle of the day’s range and you’re flat. You have a hunch (or better yet know the odds) that price will break out of that range in a certain direction. Even if you’re willing to place your bet, you still have to decide when the time is right. Ultimately, time in a position is risk taken and especially for short-term traders, you want to be as precise as possible with both price and time to maximize your opportunities. So maybe, just maybe, knowing the windows of time in which your instrument tends to make highs or lows can help you put even more probability on your side.

To that end I ran a fresh set of numbers on 9 popular futures contracts. And as you’ll see below, there are distinct windows of opportunity in each.

Make your browser as wide as you can, the graphs are large.

—

Methodology: For all instruments in this study I used the prior 2 years of 10 minute bars covering all hours that instrument trades. The ETH session break for each instrument started the high/low counters over again. On the X axis we have the number of times the high or low for the day was made for the time (US Pacific Time) on the Y axis. So the data is pretty simple to interpret – clusters of tall bars mean that the instrument is most likely to make highs or lows at or near that time in the future as well. It’s not a guarantee, of course, just a probability.

Period: March 24, 2016 – March 23, 2014

Instruments in Study: ES, NQ, YM, ZN, ZB, CL, ZS, ZW, 6E, GC

—

—

—

—

—

—

—

—

—